PAPER DEADLINE NOW SUNDAY AT 11:59 pm

NEXT WEEK, WE RESUME WEEKLY EMAIL WRITEUPS.

THINK OF RESEARCH PAPER TOPICS: BRIEF PRESENTATIONS IN NOVEMBER.

Tuesday: Schoen ch. 2, Hoff ch. 5

Nixon and the Supreme Court (Schoen 33-36):

| William H. Rehnquist | Harlan | Oct 22, 1971 | 68-26 No. 450 | C | Dec 10, 1971 | |||||

| Lewis F. Powell, Jr. | Black | Oct 22, 1971 | 89-1 No. 439 | C | Dec 6, 1971 | |||||

| Harry Blackmun | Fortas | Apr 15, 1970 | 94-0 No. 143 | C | May 12, 1970 | |||||

| G. Harrold Carswell | Fortas | Jan 19, 1970 | 45-51 No. 122 | R | Apr 8, 1970 | |||||

| Clement Haynsworth, Jr. | Fortas | Aug 21, 1969 | 45-55 No. 154 | R | Nov 21, 1969 | |||||

| Warren Burger3 | Warren | May 23, 1969 | 74-3 No. 35 | C | Jun 9, 1969 |

But, but, but.... "You will be better advised to watch what we do instead of what we say" -- John N. Mitchell (Schoen p. 26)

Nixon desegregates schools:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/10345345/chart2.png)

Affirmative Action: EO 11478

Shelby Steele (CMC P `96!) interviews George Shultz:

And for a "Holy Crap!" moment, read the 1972 GOP platform plank on equal rights for women:

In addition we have:

...

Required all firms doing business with the Government to have affirmative action plans for the hiring and promotion of women;

Requested Congress to expand the jurisdiction of the Commission on Civil Rights to cover sex discrimination;

Recommended and supported passage of Title IX of the Higher Education Act opposing discrimination against women in educational institutions;

Supported the Equal Employment Opportunity Act of 1972 giving the Equal Employment Opportunity Commission enforcement power in sex discrimination cases;

Continued our support of the Equal Rights Amendment to the Constitution, our Party being the first national party to back this Amendment.

Other factors beyond outright employer discrimination—the lack of child care facilities, for example—can limit job opportunities for women. For lower and middle income families, the President supported and signed into law a new tax provision which makes many child care expenses deductible for working parents. Part of the President's recent welfare reform proposal would provide comprehensive day care services so that women on welfare can work.

...

To continue progress for women's rights, we will work toward:

Ratification of the Equal Rights Amendment; Appointment of women to highest level positions in the Federal Government, including the Cabinet and Supreme Court;

Equal pay for equal work;

Elimination of discrimination against women at all levels in Federal Government;

Elimination of discrimination against women in the criminal justice system, in sentencing, rehabilitation and prison facilities;

Increased opportunities for the part time employment of women, and expanded training programs for women who want to reenter the labor force;

Elimination of economic discrimination against women in credit, mortgage, insurance, property, rental and finance contracts.

We pledge vigorous enforcement of all Federal statutes and executive orders barring job discrimination on the basis of sex.

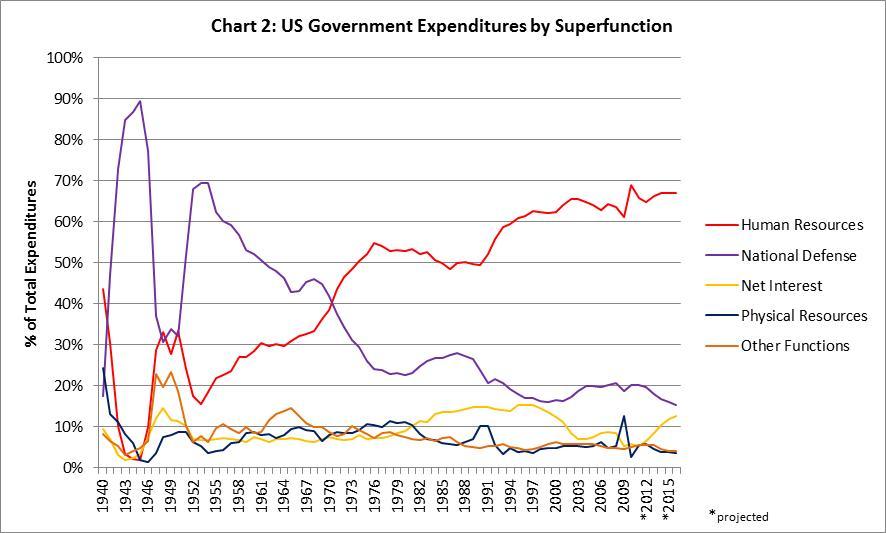

Progress Against Poverty Stalled as the War on Poverty Started

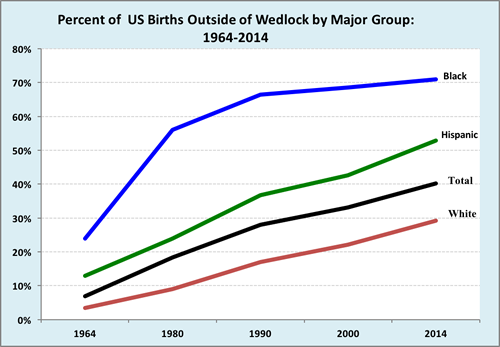

Backstory: The 1965 Moynihan Report

For Fiscal 2022

- Defense: 13.3%

- Human Resources: 73.7%

Detailed data

Gary L. Freed, Anup Das, "Nixon or Obama: Who Is the Real Radical Liberal on Health Care?" Pediatrics 136 (August 2015)

| Nixon National Health Strategy 19714 | ACA 20103,6 |

|---|---|

| National Health Insurance Partnership | Employer-Shared Responsibility |

| (1) Require employers to provide basic health insurance coverage for their employees, with the minimum requirement being to pay for hospital services, inpatient and outpatient physician services, full maternity care, well-infant care, immunizations, laboratory services, certain other medical expenses, and minimum of $50 000 in catastrophic coverage | (1) Employers with at least 50 full-time employees musoffer health coverage that is affordable and provides a minimum level of benefits to at least 95% of their employees and dependents. None of their employees can receive a premium tax credit to help pay for coverage on a marketplace; if so, the employer must make a shared responsibility payment |

| (2) The costs for this would be shared by employers and employees, with a 35% ceiling on employee contribution for the first 2.5 years, and 25% after that | (2) Affordable coverage is defined as ≤9.5% of an employee’s annual household income |

| (3) Keep the range within which benefits can vary narrower than it has been, so competition between insurance companies will be more likely to compete on overall price of contracts | (3) A plan provides the minimum level of coverage if it covers at least 60% of the total allowed cost of benefits |

| (4) Small employers are exempt from the coverage requirement and allow them to purchase insurance through the small business health options program | |

| (4) Require the establishment of special insurance pools in each state that would offer insurance at reasonable group rates to people who did not qualify for other programs: the self-employed or poor-risk individuals | |

| (5) Small employers with up to 25 employees and average annual wages less than $50 000 are eligible to receive a tax credit | |

| Medicaid | Medicaid Expansion |

| (1) Implement the Family Health Insurance Plan to meet the needs of poor families by eliminating the part of Medicaid that covers most welfare families. In its place, develop a new insurance plan that is fully financed and administered by the federal government. This federal health insurance plan would provide insurance to all poor families with children headed by self-employed or unemployed persons whose income is below a certain level. As family income increases, the cost-sharing would increase through a graduated schedule of premium charges, deductibles, and coinsurance payments | (1) Provide funding to states to expand their Medicaid programs to cover non–Medicare-eligible individuals younger than 65 with incomes up to 133% of the federal poverty line |

| (2) Guarantee all newly eligible individuals a benchmark insurance package that includes the minimum benefits for plans in the marketplace | |

| (3) Finance the coverage for the newly eligible with federal dollars until 2016, and then gradually decrease the federal contribution to 90% by 2020 | |

| (4) Increase Medicaid payments in fee for service and managed care for primary care services to 100% of Medicare payment rates | |

| Nixon Comprehensive Health Insurance Plan 19745 | |

| Employee Health Insurance | |

| (1) Require all employers to offer all full-time employees health insurance, with employee contribution at 35% for 3 years, and then 25% subsequently | |

| (2) Use federal subsidies to ease initial burden on employers | |

| (3) Specific deductible, coinsurance, and out-of-pocket limits under this insurance plan | |

| Assisted Health Insurance | |

| (1) Replace state-run Medicaid by implementing a federally administered insurance plan to cover anyone not offered coverage under the Employee Health Insurance or Medicare | |

| (2) Individuals could also get this if they cannot get coverage at reasonable rates from other options |

What did America reap from its brief fling with economic controls? The August 15, 1971 decision to impose them was politically necessary and immensely popular in the short run. But in the long run I believe that it was wrong. The piper must always be paid, and there was an unquestionably high price for tampering with the orthodox economic mechanisms.

No comments:

Post a Comment