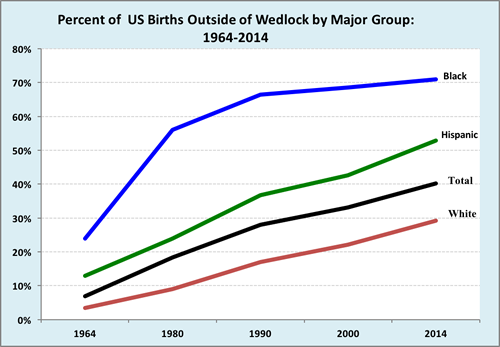

Backstory: The Moynihan Report

x

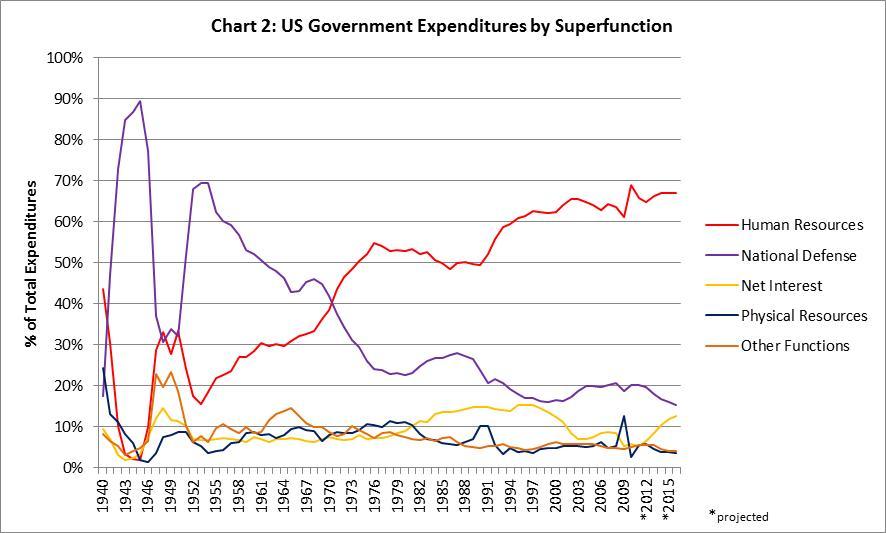

The Welfare Shift

For 2018

- Defense: 15.4%

- Human Resources: 70.7%

Gary L. Freed, Anup Das, "Nixon or Obama: Who Is the Real Radical Liberal on Health Care?" Pediatrics 136 (August 2015)

| Nixon National Health Strategy 19714 | ACA 20103,6 |

|---|---|

| National Health Insurance Partnership | Employer-Shared Responsibility |

| (1) Require employers to provide basic health insurance coverage for their employees, with the minimum requirement being to pay for hospital services, inpatient and outpatient physician services, full maternity care, well-infant care, immunizations, laboratory services, certain other medical expenses, and minimum of $50 000 in catastrophic coverage | (1) Employers with at least 50 full-time employees must offer health coverage that is affordable and provides a minimum level of benefits to at least 95% of their employees and dependents. None of their employees can receive a premium tax credit to help pay for coverage on a marketplace; if so, the employer must make a shared responsibility payment |

| (2) The costs for this would be shared by employers and employees, with a 35% ceiling on employee contribution for the first 2.5 years, and 25% after that | (2) Affordable coverage is defined as ≤9.5% of an employee’s annual household income |

| (3) Keep the range within which benefits can vary narrower than it has been, so competition between insurance companies will be more likely to compete on overall price of contracts | (3) A plan provides the minimum level of coverage if it covers at least 60% of the total allowed cost of benefits |

| (4) Small employers are exempt from the coverage requirement and allow them to purchase insurance through the small business health options program | |

| (4) Require the establishment of special insurance pools in each state that would offer insurance at reasonable group rates to people who did not qualify for other programs: the self-employed or poor-risk individuals | |

| (5) Small employers with up to 25 employees and average annual wages less than $50 000 are eligible to receive a tax credit | |

| Medicaid | Medicaid Expansion |

| (1) Implement the Family Health Insurance Plan to meet the needs of poor families by eliminating the part of Medicaid that covers most welfare families. In its place, develop a new insurance plan that is fully financed and administered by the federal government. This federal health insurance plan would provide insurance to all poor families with children headed by self-employed or unemployed persons whose income is below a certain level. As family income increases, the cost-sharing would increase through a graduated schedule of premium charges, deductibles, and coinsurance payments | (1) Provide funding to states to expand their Medicaid programs to cover non–Medicare-eligible individuals younger than 65 with incomes up to 133% of the federal poverty line |

| (2) Guarantee all newly eligible individuals a benchmark insurance package that includes the minimum benefits for plans in the marketplace | |

| (3) Finance the coverage for the newly eligible with federal dollars until 2016, and then gradually decrease the federal contribution to 90% by 2020 | |

| (4) Increase Medicaid payments in fee for service and managed care for primary care services to 100% of Medicare payment rates | |

| Nixon Comprehensive Health Insurance Plan 19745 | |

| Employee Health Insurance | |

| (1) Require all employers to offer all full-time employees health insurance, with employee contribution at 35% for 3 years, and then 25% subsequently | |

| (2) Use federal subsidies to ease initial burden on employers | |

| (3) Specific deductible, coinsurance, and out-of-pocket limits under this insurance plan | |

| Assisted Health Insurance | |

| (1) Replace state-run Medicaid by implementing a federally administered insurance plan to cover anyone not offered coverage under the Employee Health Insurance or Medicare | |

| (2) Individuals could also get this if they cannot get coverage at reasonable rates from other options |

Wage-Price Controls (Schoen 45-47): A Rare Admission of Error

What did America reap from its brief fling with economic controls? The August 15, 1971 decision to impose them was politically necessary and immensely popular in the short run. But in the long run I believe that it was wrong. The piper must always be paid, and there was an unquestionably high price for tampering with the orthodox economic mechanisms.

No comments:

Post a Comment